Popcorn has become the unlikely star of a recent debate in India’s tax system, sparking conversations about fairness, complexity, and the larger implications of the Goods and Services Tax (GST). From movie theatres to packaged goods, the way popcorn is taxed has raised eyebrows and led to public outcry.

What’s Happening with Popcorn Taxation?

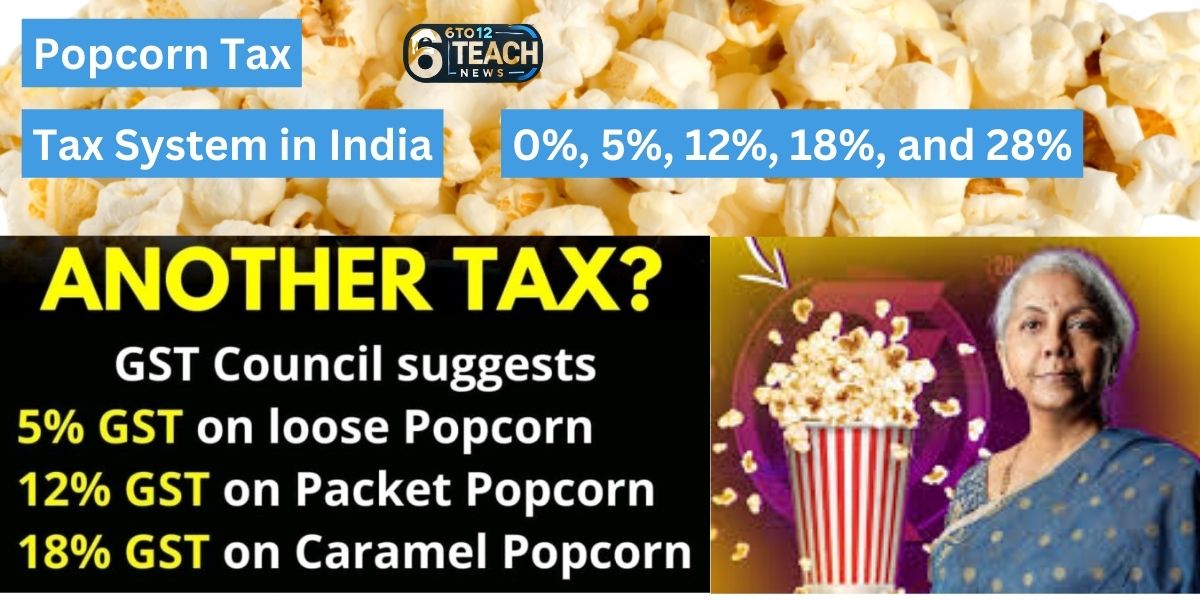

Under India’s GST system, popcorn isn’t just popcorn—it’s classified differently depending on how it’s sold or prepared. Here’s how it breaks down:

- Loose Popcorn (Unpackaged and Unlabelled)

If you buy popcorn served fresh in movie theatres or at stalls, it’s considered part of a restaurant service and taxed at 5% GST. - Pre-Packaged and Labelled Popcorn

The ready-to-eat popcorn you grab off supermarket shelves—packaged and labeled—comes with a 12% GST. - Caramelized Popcorn

If your popcorn is caramel-coated or mixed with sugar, it’s treated as confectionery and taxed at a steep 18% GST.

Why Is This in the News?

The seemingly minor issue of popcorn taxation has grown into a larger conversation about how India’s GST system operates. Critics argue that such distinctions are unnecessarily complicated and contradict the GST’s original goal of simplifying the tax structure.

Former Chief Economic Adviser K.V. Subramanian even weighed in, calling the system “a bureaucrat’s delight and a citizen’s nightmare.” He questioned why these detailed classifications are necessary when they barely contribute to overall tax revenue but confuse businesses and consumers alike.

Tax System in India: GST Rates for Goods and Services

The Goods and Services Tax (GST) in India is categorized into five main slabs: 0%, 5%, 12%, 18%, and 28%, with some items exempted or taxed at a special rate. Below is a simplified table:

| Category | Examples | GST Rate |

| Exempted | Fresh fruits, vegetables, milk, eggs, curd, salt | 0% |

| Educational services, healthcare services | ||

| 5% | Edible oils, sugar, tea, coffee (not instant), | 5% |

| medicines, fertilizers, transport services | ||

| 12% | Packed food items (e.g., packaged popcorn), | 12% |

| textiles, footwear (₹1,000 or less), bicycles | ||

| 18% | Instant coffee, cakes, biscuits, air conditioners, | 18% |

| soaps, IT services, restaurant services | ||

| 28% | Luxury items: cars (over 1500cc engine), | 28% |

| tobacco, aerated drinks, high-end electronics |

GST Special Rates

| Category | Description | Rate |

| Gold & Precious Metals | Gold and jewelry | 3% |

| Real Estate | Affordable housing | 1% (without ITC) |

| Other residential properties | 5% (without ITC) |

Key Points to Note

- Zero-rated Exports: Exports are zero-rated, meaning no GST is charged, but input tax credit (ITC) can be claimed.

- Composition Scheme: Small businesses with turnover up to ₹1.5 crore can opt for a simplified tax rate under this scheme (1% GST for traders/manufacturers).

- Luxury Cess: Items in the 28% slab may also have an additional cess for specific goods like luxury cars and tobacco.

The Public’s Reaction

The popcorn tax debate has also gone viral on social media, with many Indians expressing frustration at the perceived absurdity. “How can the same popcorn be taxed differently just because it’s packed?” is a common sentiment.

To address these concerns, Finance Minister Nirmala Sitharaman defended the GST Council’s decisions, explaining that sugar-added products fall under different tax categories to maintain consistency across the system.

What This Means for You

At its core, this debate isn’t just about popcorn—it’s about the complexity of taxation. The issue raises questions like:

- Should similar products be taxed differently based on packaging and preparation?

- Is the system fair, or does it burden businesses and consumers unnecessarily?

What’s Next?

This controversy could push the GST Council to review its classifications and address public concerns. Whether the system gets simplified remains to be seen, but for now, popcorn lovers may have to live with this “tax drama” every time they head to the movies or shop for snacks.

The popcorn tax story is a small example of a big issue: how India balances revenue generation with simplicity and fairness in its tax policies. Stay tuned—it might just lead to some long-overdue changes.

FAQs

The taxation of popcorn has become controversial due to its different GST rates based on how it is sold or prepared. Loose popcorn in theatres is taxed at 5%, pre-packaged popcorn at 12%, and caramelized popcorn at 18%. These variations have sparked discussions about the complexity and fairness of the GST system.

► Loose/unpackaged popcorn (e.g., served in theatres): 5% GST

► Pre-packaged and labelled popcorn: 12% GST

► Caramelized or sugar-coated popcorn: 18% GST

Critics argue that such detailed classifications contradict GST’s purpose of simplifying taxation. The complexity confuses consumers and businesses while contributing minimally to overall tax revenue.

Many consumers have taken to social media to express frustration, finding it absurd that the same popcorn can have different tax rates based solely on packaging or preparation. The issue has brought broader concerns about the GST system into the spotlight.

The popcorn tax debate has highlighted the need for a review of GST classifications. While there’s no official confirmation, the controversy may prompt the GST Council to reconsider the rules and potentially simplify the tax structure for goods like popcorn.